By: Suzan Hall, CFS®

New CalSavers deadlines are approaching!

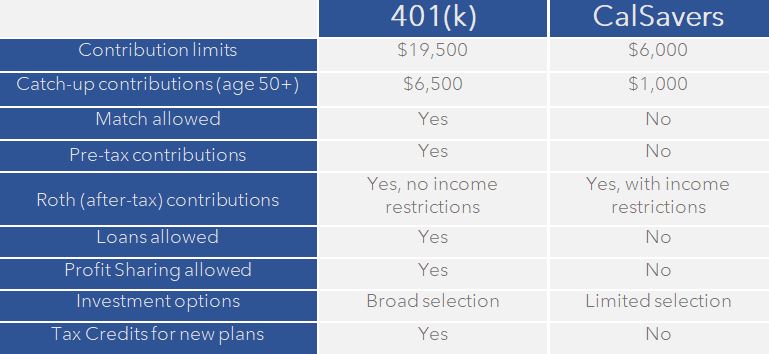

New deadlines are approaching for the California state-mandated CalSavers Retirement Savings Program, requiring many small businesses without an employer-sponsored retirement plan to either register for CalSavers or establish their own plan, such as a 401(k) plan. CalSavers (previously called Secure Choice) started out as a pilot program and was introduced statewide to all eligible employers on July 1, 2019. California employers with 5 or more employees (full-time or part-time) are required by state law to offer a retirement plan to their employees. However, employers do not have to offer CalSavers. They can establish a plan that is right for their business. Before making a decision, it is important to understand the differences between CalSavers and more traditional plans, like a 401(k). Below is a helpful fact sheet to learn more. Contact TRPC to help you explore your options.

Key Points about CalSavers:

- CalSavers is a Roth IRA, which has income limitations

- Employees are automatically enrolled at 5% of pay

- State law requires businesses with 5 or more employees to offer a retirement plan

- If employers do not establish a retirement plan by the state-mandated deadlines, penalties will apply from $250 per employee and more

- Businesses do not have to offer CalSavers. You can offer a 401(k) or another employer-sponsored retirement plan. TRPC can help you explore your options

Important deadlines to establish a retirement plan for your business:

| Sept. 30, 2020 | 100+ employees |

| June 30, 2021 | 50+ employees |

| June 30, 2022 | 5+ employees |