By: Jerry Alena

Cash balance plans can help professional practitioners turn back time when it comes to saving for retirement. Because medical professionals spend a lot of time and money investing in their careers early on, they may not be able to invest in a retirement plan on a material basis until their 40s or 50s. College debt, medical school debt, years of practicing at lower wage points, and the debt to purchase a practice can make saving for retirement early in their career a luxury.

One of our recent clients, Dr. Patrick, experienced this problem first-hand. A dermatologist, Dr. Patrick had six-figure student loan debt early on and borrowed over a million dollars to purchase his practice. That and a family of five made it difficult to get ahead. Now, at age 50, and with most of his financial headwinds behind him, Dr. Patrick seeks to save more for retirement. He is a perfect candidate for a 401(k) and cash balance combination plan.

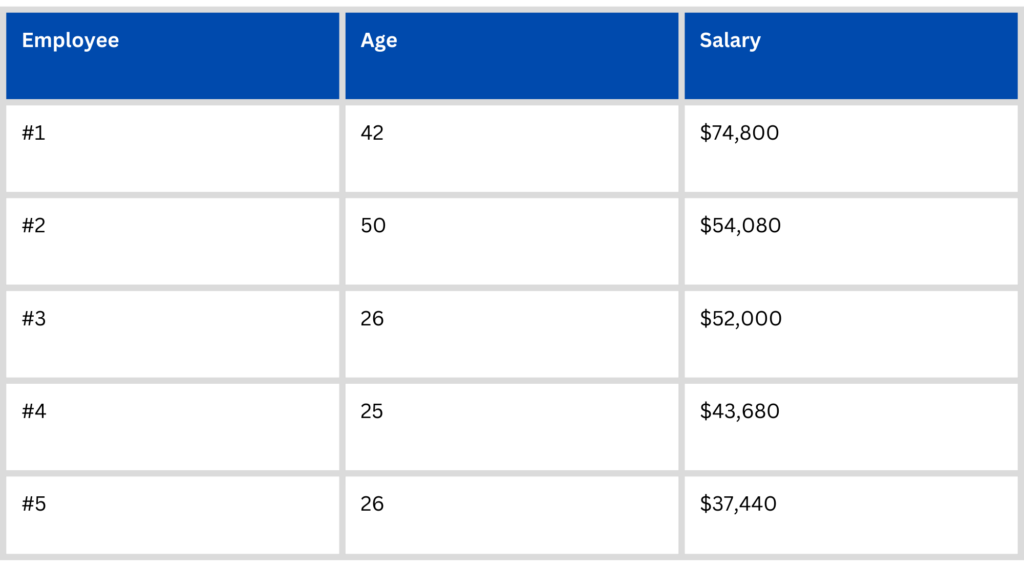

Some facts – Dr. Patrick makes over $330,000/yr. (the most the IRS will consider for funding retirement). He has 5 employees that make between $35,000 and $75,000/yr. Their ages and salaries are as follows:

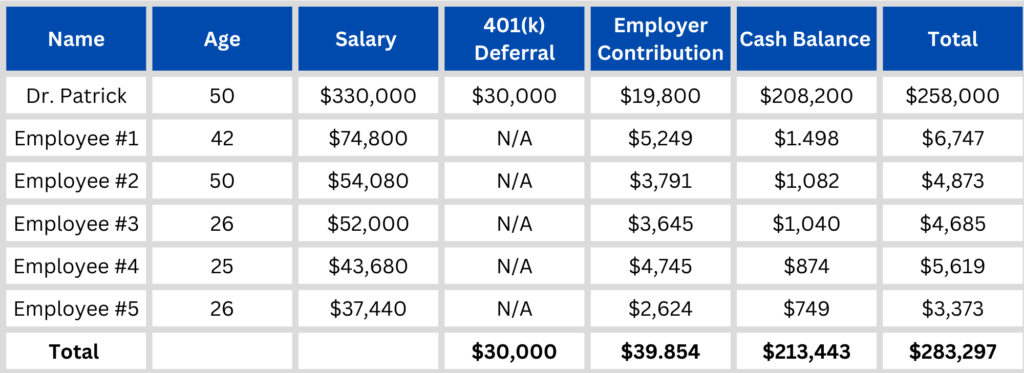

Cash balance plans are true pensions. As a result, the contribution formulas favor higher compensated, older employees. When paired with a 401(k), a business owner can benefit further from the 401(k) deferral and gain some flexibility in funding the plan for their employees. As a result, Dr. Patrick can maximize his contribution for himself and minimize the contribution for his younger employees:

When you account for the 401(k) contribution (because Dr. Patrick is 50, he can defer $30,000 when you include the $7,500 catch-up contribution along with the $22,500 401(k) limit), Dr. Patrick receives 91% of the contribution to the plan.

This supercharged contribution allows Dr. Patrick to make up for the time he lost while investing in his career, not exactly turning back the clock, but allowing him to make up for lost time.

For more information please visit www.trpcweb.com or contact us.